Highlights

- Aeva Inc. (“Aeva”) is the leading provider of comprehensive perception solutions developed on Silicon Photonics for mass scale applications in automotive, consumer electronics, consumer health, industrial and security markets.

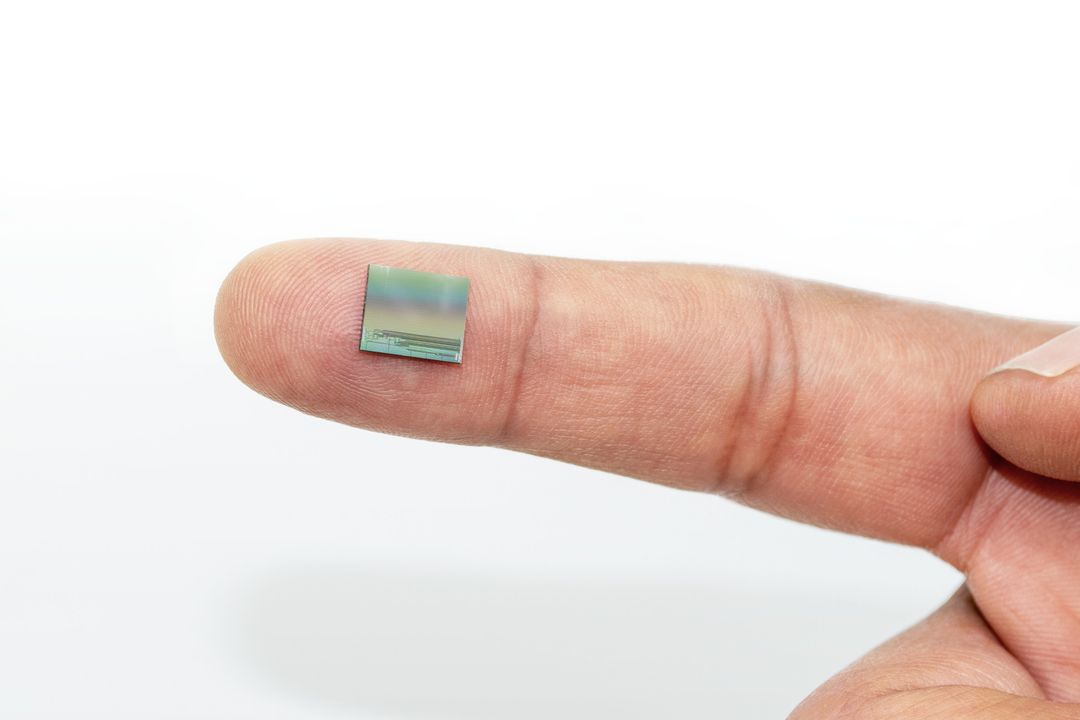

- Aeva’s groundbreaking 4D LiDAR on Chip combines instant velocity measurements and long-range performance at affordable costs for commercialization at silicon scale.

- Aeva has received strategic investments from Porsche SE, the major shareholder of VW Group.

- Aeva’s commercial partners also include other top automotive OEMs and world’s leading mobility and technology players.

- In September, Aeva announced a production partnership with ZF to manufacture and distribute the first automotive grade 4D LiDAR to global OEM customers.

- Business combination to provide up to $363M in gross proceeds, comprised of InterPrivate’s $243M held in trust[1] and a $120M fully committed common stock PIPE at $10.00 per share, including investments from Adage Capital and Porsche SE.

- Combined company expected to have an estimated post-transaction equity value of approximately $2.1B and is expected to be listed on the NYSE under the ticker symbol AEVA following anticipated transaction close in Q1 2021.

- All Aeva stockholders, including Lux Capital, Canaan Partners, and Lockheed Martin, will retain their equity holdings through Aeva’s transition into the publicly listed company.

- Aeva plans to use 100% of the net proceeds from the transaction to accelerate its growth and commercialization.

InterPrivate Acquisition Corp (“InterPrivate”) (NYSE: IPV), a special purpose acquisition company, announced today that it has entered into a definitive agreement for a business combination with Aeva, Inc. (“Aeva”), the first company to provide a perception platform built from the ground up on Silicon Photonics for mass scale application in automotive, consumer electronics and other sectors. Upon closing of the transaction, the combined company will be renamed “Aeva, Inc.” and is expected to continue to be listed on the New York Stock Exchange and trade under the ticker symbol “AEVA.”

Founded in 2017 by former Apple engineers Soroush Salehian and Mina Rezk and led by a multidisciplinary team of over 100 experienced leaders, engineers, and operators, Aeva is actively engaged with thirty of the top players in automated and autonomous driving across passenger, trucking and mobility.

- In 2019, Aeva announced a partnership with Audi’s Autonomous Intelligent Driving entity. Aeva has also partnered with multiple other passenger car, trucking and mobility platforms to further adoption of ADAS and autonomous applications.

- Aeva is in a production partnership with ZF, one of the world’s largest automotive Tier 1 manufacturers to top OEMs, to supply the first automotive grade 4D LiDAR from select ZF production plants. The partnership — Aeva’s expertise in FMCW LiDAR technology combined with ZF’s experience in industrialization of automotive grade sensors — represents a key commitment to accelerate mass production of safe and scalable 4D LiDAR technology.

With its powerful software stack, Aeva plans to bring its perception platform to a range of industries beyond automotive, including consumer electronics, consumer health, industrial robotics, and security.

Unlike legacy LiDAR, which relies on Time of Flight (ToF) technology and measures only depth and reflectivity, Aeva’s groundbreaking solution uses a unique Frequency Modulated Continuous Wave (FMCW) technology to measure velocity in addition to depth, reflectivity and inertial motion. Aeva’s innovative FMCW technology draws on significantly less power than other available technologies, including ToF, to bring perception to broad applications at an industry-leading cost.

“From the beginning our vision has been to create a fundamentally new sensing system to enable perception across all devices. This milestone accelerates our journey toward delivering the next paradigm in perception to mass market applications, not just in automotive but consumer and beyond,” said Soroush Salehian, Co-founder and CEO at Aeva.

Mina Rezk, Co-founder and CTO at Aeva, said, “From the beginning, we believed that the only way to achieve the holy grail of LiDAR is to be integrated on a chip. Over the last four years, we did it by leveraging Aeva’s unique coherent FMCW approach. With today’s announcement, we can use our development efforts to expand into new markets that were simply not possible before.”

Ahmed Fattouh, Chairman and Chief Executive Officer of InterPrivate said, “We look forward to our combination with Aeva, which was the clear stand-out amongst the 100+ merger targets we evaluated. The Company’s breakthrough technology combines the key advantages of LiDAR, Radar, Motion Sensing, and Vision in a single compact chip. As a result of this transaction, including the upsized PIPE private placement, Aeva is not expected to require any additional funding to achieve significant cash flow through its commercial partnerships with world class customers. Soroush, Mina and their team are revolutionizing sensing solutions not only for the automotive industry, but ultimately across all devices.”

Transaction overview

The combined company will have an implied pro forma equity value of approximately $2.1 billion at closing, and Aeva’s existing stockholders will hold approximately 80% of the issued and outstanding shares of common stock of the combined company immediately following the closing.

Cash proceeds in connection with the transaction will be funded through a combination of (i) the issuance of approximately $120 million of common stock through a fully committed private placement at $10.00 per share, including investments from Adage Capital and Porsche SE, (ii) the issuance of $ 1.7 billion of new common stock of InterPrivate to current stockholders of Aeva subject to customary adjustments and (iii) $243 million of cash held in trust assuming no redemptions by InterPrivate’s existing public stockholders.

The boards of directors of both InterPrivate and Aeva have unanimously approved the proposed business combination. Completion of the proposed business combination is subject to, among other things, the approval by InterPrivate and Aeva stockholders and the satisfaction or waiver of other customary closing conditions, including a registration statement being declared effective by the Securities and Exchange Commission (the “SEC”), and is expected to occur in the first quarter of 2021.

Following completion of the transaction, Aeva will retain its experienced management team. Soroush Salehian will continue to serve as Chief Executive Officer, Mina Rezk will continue to serve as Chief Technology Officer and Saurabh Sinha will continue to serve as Chief Financial Officer.

Advisors

Morgan Stanley & Co. LLC is serving as financial advisor and lead private placement agent on the PIPE offering, and Greenberg Traurig is serving as legal advisor to InterPrivate. Credit Suisse Securities (USA) LLC is acting as capital markets advisor, and Latham & Watkins LLP is serving as legal advisor to Aeva. Credit Suisse Securities (USA) LLC also served as placement agent on the PIPE offering for InterPrivate. Additionally, Davis Polk & Wardwell LLP is serving as legal counsel to Morgan Stanley & Co. LLC and Credit Suisse Securities (USA) LLC.