Major smart card market participants include CardLogix Corporation, Card com Technology, Infineon Technologies AG, Verifone Inc., CPI Card Group, NXP Semiconductors NV, Giesecke & Devrient (G&D) GmbH, IDEMIA, Identiv Inc., Thales Group, and Square, Inc., etc.

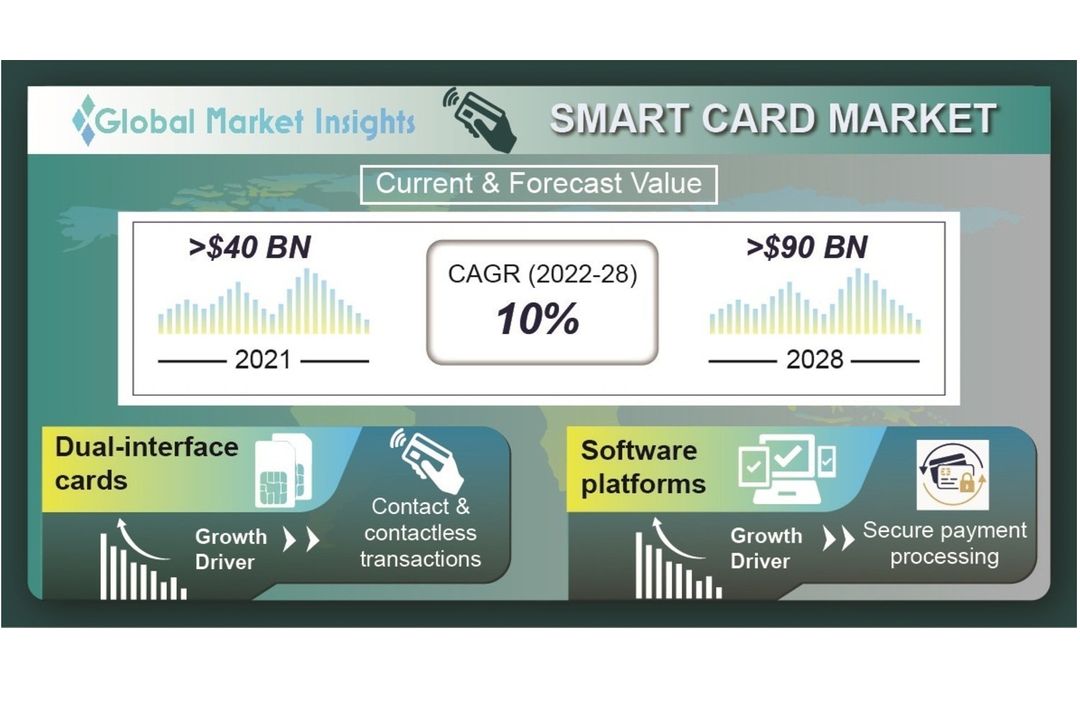

SELBYVILLE- The smart card market is expected to surpass USD 90 billion by 2028, as reported in a research study by Global Market Insights Inc. The market growth can be attributed to the increasing demand for robust access control solutions globally.

Dual-interface cards that can facilitate both contact and contactless transactions will witness increasing popularity over the forecast timespan. With these cards, the user can access the same chip with either of these methods, thereby ensuring multipurpose usage at any payment terminal with a high level of security. Dual-interface smart cards will observe increasing adoption owing to their fast transaction speeds and high confidentiality. These cards are used as citizen ID cards, employee ID badges, transit payment cards, and GSM subscriber identity modules. The chips used in these cards fall into two categories including microcontroller chips and memory chips.

The expanding global IT & telecom sector will offer growth opportunities to the smart card market. Smart cards are used as stored memory cards and as Universal Integrated Circuit Card (UICC) or the Subscriber Identity Module (SIM) in smartphones. A SIM detects and validates a subscriber to a wireless cell phone network. The expanding 5G sector will offer growth opportunities to the market. A 5G connection depends on the SIM card supporting the G network and 5G frequency band. The increasing use of smartphones globally will fuel the demand for advanced smart cards that can be integrated into the phones.

The growing penetration of digitalization in Latin America will offer growth opportunities to the smart card industry. Several countries in Latin America are including multiple payment options to minimize cash and metro card usage. There is an increasing focus on EMV contactless payments using credit & debit cards. More than 87% of POS machines in Chile are contactless as of January 2022.

The developing transportation sector will also encourage authorities to install smart card readers at the entry and exit gates for traveler convenience. Market players are expanding their presence in the region in response to the increasing demand from several end-use sectors. For instance, in October 2020, Rappi launched its credit card in Colombia in collaboration with Visa and the Colombian bank, Davivienda. This card integrates Visa contactless technology and reached 20% of face-to-face Visa transactions in Colombia in August 2020.

Some major findings of the smart card market report are:

- The growing popularity of cashless payment solutions is encouraging players to offer innovative smart cards for simplifying payment transactions. There is an increasing demand for contactless payment techniques in the wake of the pandemic. Technological advancements, such as NFC and RFID, that enable seamless digital transactions will support the adoption of these cards.

- Smart cards secure consumer information in an encrypted format and are cost-effective with faster processing. These cards allow consumers to manage expenditures with automatic limits and reporting. Enhanced data security is a key factor driving the smart card industry’s growth.

- Smart card technology providers are focusing on enhancing their offerings by integrating biometric technology into cards. This will enable further enhancement in transaction security and ensure authorized use. The need to eliminate the hassle of entering pins is encouraging market players to innovate biometric cards.

- Government initiatives in several countries supporting digitalization provide growth opportunities to the smart card industry. Government initiatives in several countries, such as Digital India and Digital Strategy 2025 in Germany, supporting the adoption of the technology will, in turn, support the smart card market growth.

- Online retailers focus on enhancing their logistics capabilities by incorporating digital payment techniques to ensure customer convenience. They incorporate smart card readers to enable consumers to pay on delivery. With e-commerce gaining traction, market players will allocate smart card readers to delivery executives to ensure fast transactions at the customer’s point.