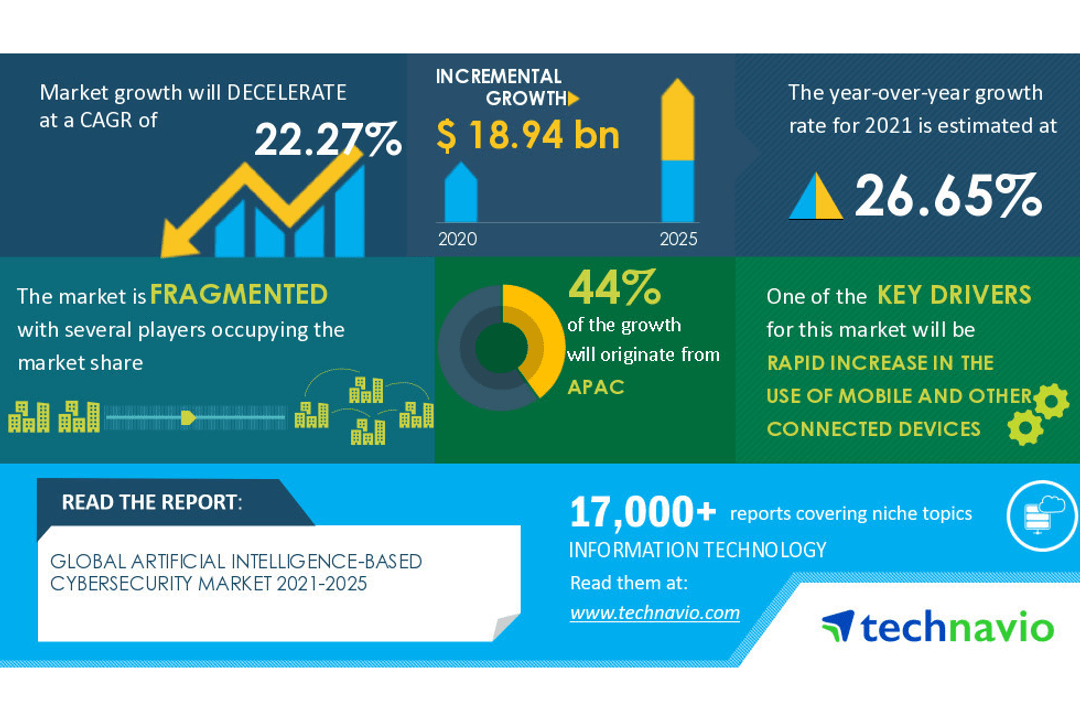

NEW YORK – Do you know the Artificial Intelligence-Based Cybersecurity Market size is expected to grow by USD 18.94 billion at a CAGR of 22.27% during the forecast period? Technavio’s latest report on the artificial intelligence-based cybersecurity market is segmented by End-user and Geography is curated by covering all market trends, regional outlook, competitive landscape, and comprehensive analysis of business needs & impeccable growth strategies.

Amazon.com Inc., AO Kaspersky Lab, Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., Dell Technologies Inc., Fortinet Inc., Hewlett Packard Enterprise Co., Intel Corp., and International Business Machines Corp. are some of the major market participants.

To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The rapid increase in the use of mobile and other connected devices is notably driving the artificial intelligence-based cybersecurity market growth, although factors such as technical difficulties in developing ai technologies may impede the market growth. Request for a Sample Report!Artificial Intelligence-based Cybersecurity Market Segmentation

- End-user

- BFSI

- Government

- ICT

- Healthcare

- Others

- Geography

- APAC

- North America

- Europe

- South America

- MEA

APAC will account for 44% of market growth. The main markets in APAC for artificial intelligence-based cybersecurity are China, Japan, and India. This region’s market will expand more quickly than those in other areas. Over the projection period, the increasing use of mobile devices would support the expansion of the artificial intelligence-based cybersecurity market in APAC.

Get the sample report for additional insights into the contribution of all the segments, and regional opportunities in the report.Artificial Intelligence-based Cybersecurity Market Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. Our artificial intelligence-based cybersecurity market report covers the following areas:

- Artificial Intelligence-based Cybersecurity Market size

- Artificial Intelligence-based Cybersecurity Market trends

- Artificial Intelligence-based Cybersecurity Market industry analysis

Artificial Intelligence-based Cybersecurity Market Vendor Analysis

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Amazon.com Inc.

- AO Kaspersky Lab

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- Intel Corp.

- International Business Machines Corp.

Technavio categorizes the global AI-based cybersecurity market as a part of the global systems software market within the global information technology market.

The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global systems software market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

Online Corporate Meeting Services Market by Application and Geography – Forecast and Analysis 2022-2026: The online corporate meeting services market share is expected to increase to USD 5.58 billion from 2021 to 2026, at a CAGR of 14.78%.

Low Code Development Platform Market by Product and Geography – Forecast and Analysis 2022-2026: At an accelerating CAGR of 27.96%, the low code development platform market share is expected to increase to USD 35.73 billion from 2021 to 2026.

| Artificial Intelligence-based Cybersecurity Market Scope | |

| Report Coverage | Details |

| Page number | 120 |

| Base year | 2020 |

| Forecast period | 2021-2025 |

| Growth momentum & CAGR | Decelerate at a CAGR of 22.27% |

| Market growth 2021-2025 | $ 18.94 billion |

| Market structure | Fragmented |

| YoY growth (%) | 26.65 |

| Regional analysis | APAC, North America, Europe, South America, and MEA |

| Performing market contribution | APAC at 44% |

| Key consumer countries | US, China, UK, Japan, and Germany |

| Competitive landscape | Leading companies, Competitive strategies, Consumer engagement scope |

| Key companies profiled | Amazon.com Inc., AO Kaspersky Lab, Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., Dell Technologies Inc., Fortinet Inc., Hewlett Packard Enterprise Co., Intel Corp., and International Business Machines Corp. |

| Market dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

| Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table Of Contents :

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value chain analysis: System software market

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.3 Market size 2020

- 3.4 Market outlook: Forecast for 2020 – 2025

- Exhibit 06: Global – Market size and forecast 2020 – 2025 ($ million)

- Exhibit 07: Global market: Year-over-year growth 2020 – 2025 (%)

4 Five Forces Analysis

- 4.1 Five Forces Summary

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition – Five forces 2020

5 Market Segmentation by End-user

- 5.1 Market segments

- Exhibit 15: End user – Market share 2020-2025 (%)

- 5.2 Comparison by End user

- Exhibit 16: Comparison by End user

- 5.3 BFSI – Market size and forecast 2020-2025

- Exhibit 17: BFSI – Market size and forecast 2020-2025 ($ million)

- Exhibit 18: BFSI – Year-over-year growth 2020-2025 (%)

- 5.4 Government – Market size and forecast 2020-2025

- Exhibit 19: Government – Market size and forecast 2020-2025 ($ million)

- Exhibit 20: Government – Year-over-year growth 2020-2025 (%)

- 5.5 ICT – Market size and forecast 2020-2025

- Exhibit 21: ICT – Market size and forecast 2020-2025 ($ million)

- Exhibit 22: ICT – Year-over-year growth 2020-2025 (%)

- 5.6 Healthcare – Market size and forecast 2020-2025

- Exhibit 23: Healthcare – Market size and forecast 2020-2025 ($ million)

- Exhibit 24: Healthcare – Year-over-year growth 2020-2025 (%)

- 5.7 Others – Market size and forecast 2020-2025

- Exhibit 25: Others – Market size and forecast 2020-2025 ($ million)

- Exhibit 26: Others – Year-over-year growth 2020-2025 (%)

- 5.8 Market opportunity by End user

- Exhibit 27: Market opportunity by End user

6 Customer landscape

7 Geographic Landscape

- 7.1 Geographic segmentation

- Exhibit 29: Market share by geography 2020-2025 (%)

- 7.2 Geographic comparison

- Exhibit 30: Geographic comparison

- 7.3 APAC – Market size and forecast 2020-2025

- Exhibit 31: APAC – Market size and forecast 2020-2025 ($ million)

- Exhibit 32: APAC – Year-over-year growth 2020-2025 (%)

- 7.4 North America – Market size and forecast 2020-2025

- Exhibit 33: North America – Market size and forecast 2020-2025 ($ million)

- Exhibit 34: North America – Year-over-year growth 2020-2025 (%)

- 7.5 Europe – Market size and forecast 2020-2025

- Exhibit 35: Europe – Market size and forecast 2020-2025 ($ million)

- Exhibit 36: Europe – Year-over-year growth 2020-2025 (%)

- 7.6 South America – Market size and forecast 2020-2025

- Exhibit 37: South America – Market size and forecast 2020-2025 ($ million)

- Exhibit 38: South America – Year-over-year growth 2020-2025 (%)

- 7.7 MEA – Market size and forecast 2020-2025

- Exhibit 39: MEA – Market size and forecast 2020-2025 ($ million)

- Exhibit 40: MEA – Year-over-year growth 2020-2025 (%)

- 7.8 Key leading countries

- Exhibit 41: Key leading countries

- 7.9 Market opportunity by geography

- Exhibit 42: Market opportunity by geography ($ million)

8 Drivers, Challenges, and Trends

- 8.1 Market drivers

- 8.2 Market challenges

- 8.3 Market trends

9 Vendor Landscape

- 9.1 Overview

- Exhibit 44: Vendor landscape

- 9.2 Landscape disruption

- Exhibit 45: Landscape disruption

- Exhibit 46: Industry risks

- 9.3 Competitive Scenario

10 Vendor Analysis

- 10.1 Vendors covered

- Exhibit 47: Vendors covered

- 10.2 Market positioning of vendors

- Exhibit 48: Market positioning of vendors

- 10.3 Amazon.com Inc.

- Exhibit 49: Amazon.com Inc. – Overview

- Exhibit 50: Amazon.com Inc. – Business segments

- Exhibit 51: Amazon.com Inc. – Key news

- Exhibit 52: Amazon.com Inc. – Key offerings

- Exhibit 53: Amazon.com Inc. – Segment focus

- 10.4 AO Kaspersky Lab

- Exhibit 54: AO Kaspersky Lab – Overview

- Exhibit 55: AO Kaspersky Lab – Product and service

- Exhibit 56: AO Kaspersky Lab – Key offerings

- 10.5 Broadcom Inc.

- Exhibit 57: Broadcom Inc. – Overview

- Exhibit 58: Broadcom Inc. – Business segments

- Exhibit 59: Broadcom Inc. – Key offerings

- Exhibit 60: Broadcom Inc. – Segment focus

- 10.6 Check Point Software Technologies Ltd.

- Exhibit 61: Check Point Software Technologies Ltd. – Overview

- Exhibit 62: Check Point Software Technologies Ltd. – Business segments

- Exhibit 63: Check Point Software Technologies Ltd. – Key news

- Exhibit 64: Check Point Software Technologies Ltd. – Key offerings

- 10.7 Cisco Systems Inc.

- Exhibit 65: Cisco Systems Inc. – Overview

- Exhibit 66: Cisco Systems Inc. – Business segments

- Exhibit 67: Cisco Systems Inc. – Key news

- Exhibit 68: Cisco Systems Inc. – Key offerings

- Exhibit 69: Cisco Systems Inc. – Segment focus

- 10.8 Dell Technologies Inc.

- Exhibit 70: Dell Technologies Inc. – Overview

- Exhibit 71: Dell Technologies Inc. – Business segments

- Exhibit 72: Dell Technologies Inc. – Key offerings

- Exhibit 73: Dell Technologies Inc. – Segment focus

- 10.9 Fortinet Inc.

- Exhibit 74: Fortinet Inc. – Overview

- Exhibit 75: Fortinet Inc. – Business segments

- Exhibit 76: Fortinet Inc. – Key offerings

- 10.10 Hewlett Packard Enterprise Co.

- Exhibit 77: Hewlett Packard Enterprise Co. – Overview

- Exhibit 78: Hewlett Packard Enterprise Co. – Business segments

- Exhibit 79: Hewlett Packard Enterprise Co. – Key offerings

- Exhibit 80: Hewlett Packard Enterprise Co. – Segment focus

- 10.11 Intel Corp.

- Exhibit 81: Intel Corp. – Overview

- Exhibit 82: Intel Corp. – Business segments

- Exhibit 83: Intel Corp. – Key news

- Exhibit 84: Intel Corp. – Key offerings

- Exhibit 85: Intel Corp. – Segment focus

- 10.12 International Business Machines Corp.

- Exhibit 86: International Business Machines Corp. – Overview

- Exhibit 87: International Business Machines Corp. – Business segments

- Exhibit 88: International Business Machines Corp. – Key news

- Exhibit 89: International Business Machines Corp. – Key offerings

- Exhibit 90: International Business Machines Corp. – Segment focus

11 Appendix

- 11.1 Scope of the report

- 11.2 Currency conversion rates for US$

- Exhibit 91: Currency conversion rates for US$

- 11.3 Research methodology

- Exhibit 92: Research Methodology

- Exhibit 93: Validation techniques employed for market sizing

- Exhibit 94: Information sources

- 11.4 List of abbreviations

- Exhibit 95: List of abbreviations